alameda county property tax calculator

The tax type should appear in the upper left corner of your bill. Many vessel owners will see an increase in their 2022 property tax valuations.

Decline In Market Value Alameda County Assessor

California Property Tax Calculator.

. This map shows property tax in correlation with square footage of the property. Ad Compare Loan Options Calculate Payments Get Quotes - All Online. If you have atypical situations or have additional questions about supplemental assessments please call the Assessors Office at 510 272-3787.

Alameda County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax. Estimating Your Taxes If the tax rate in your community has been established at 120 1 base rate plus 20 for prior indebtedness the property tax would be calculated as follows. The valuation factors calculated by the State Board of Equalization and provided to California County Assessors through LTA 2022003 indicate an increase in 2022 values between 20-24 depending on the type of vessel.

This site also enables you to access your tax information. The forms you need and the procedures youll comply with are found at the county tax office or online. Dear Alameda County Residents.

Enter the purchase date in mmddyyyy format eg 05152007. 3600 Median Home Value. The Treasurer-Tax Collector TTC does not conduct in-person visits to collect property taxes.

Alameda County is responsible for computing the tax value of your real estate and that is where you will register your appeal. The State Board of Equalization reviews average. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

52 The average Oakland property tax rate for Alameda County is 090. The valuation factors calculated by the State Board of Equalization and provided to California County Assessors through LTA 2022003 indicate an increase in 2022 values between 20-24 depending on the type of vessel. 400000 Median Household Income.

Lookup or pay delinquent prior year taxes for or earlier. The tax amount may be adjusted for any special benefit assessments such as sewer service charges or reduced by any legal exemption which may apply. Get your property assessment and tax data with our database.

This generally occurs Sunday morning from 700 to 900 AM and weeknights from 100 to 200 AM. The State Board of Equalization reviews average. The system may be temporarily unavailable due to system maintenance and nightly processing.

No fee for an electronic check from your checking or savings account. Home_work Secured Pay lookup or download your bill. The median property tax also known as real estate tax in Alameda County is 399300 per year based on a median home value of 59090000 and a median effective property tax rate of 068 of property value.

The valuation factors calculated by the State Board of Equalization and provided to California County Assessors through LTA 2022003 indicate an increase in 2022 values between 20-24 depending on the type of vessel. Many vessel owners will see an increase in their 2022 property tax valuations. To use the Supplemental Tax Estimator please follow these instructions.

69000 Property Tax as of Income. In our calculator we take your home value and multiply that by your countys effective property tax rate. As we continue our effort to ensure the health and safety of the public and our staff our offices in Oakland and Hayward will remain closed until further notice.

Welcome to the Alameda County Treasurer-Tax Collectors website. This is equal to the median property tax paid as a percentage of the median home value in your county. Dear Alameda County Residents.

The median property tax in Alameda County California is 3993 per year for a home worth the median value of 590900. Ad Find Alameda County Online Property Tax Bill Info From 2022. A convenience fee of 25 will be charged for a credit card transaction.

Many vessel owners will see an increase in their 2022 property tax valuations. Click on the map to expand. Property Taxes - Lookup - Alameda Countys Official Website Pay Lookup Property Taxes Online Convenient.

1221 Oak Street Room 131 Oakland CA 94612. Receive Alameda County Property Records by Just Entering an Address. Alameda County Treasurer-Tax Collector.

Please choose one of the following tax types. Dear Alameda County Residents. Our staff have worked hard to provide you with online services that provide useful information about our office our work and our fiduciary obligation to safe-keep the Countys financial resources.

Alameda County collects on average 068 of a propertys assessed fair market value as property tax. Ad Learn about all your personal and commercial value for taxation. Median Annual Property Tax.

For comparison the median home value in Alameda County is 59090000. Receipt_long Supplemental For new owners. Property Taxes - Pay Online - Alameda Countys Official Website Pay Your Property Taxes Online You can pay online by credit card or by electronic check from your checking or savings account.

The median property tax paid by homeowners in the Bay Areas Contra Costa County is 4941 per year. Average Effective Property Tax Rate. The State Board of Equalization reviews average.

Search Unsecured Property Taxes

Alameda County Ca Property Tax Calculator Smartasset

Property Taxes By State County Lowest Property Taxes In The Us Mapped

Transfer Tax Alameda County California Who Pays What

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Business Property Tax In California What You Need To Know

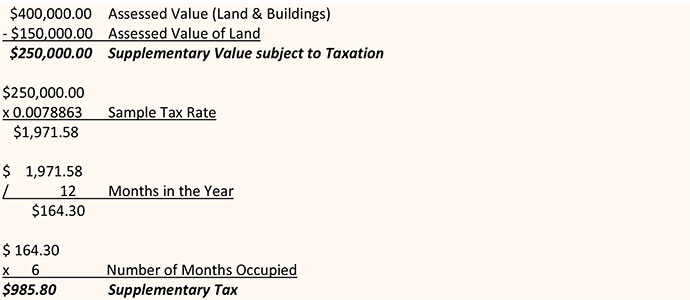

How Is Supplementary Tax Calculated The City Of Red Deer

Pin On Articles On Politics Religion

California County Map Gis Geography County Map San Bernardino County California Map

Understanding California S Property Taxes

Alameda County Ca Property Tax Search And Records Propertyshark

Business Property Tax In California What You Need To Know

Diversity Retail Real Estate The Top 20 Multicultural Markets Commercial Property Executive Marketing Retail Retail News

How Much Property Tax One Is Required To Pay On A House In California Quora

Business Property Tax In California What You Need To Know

Understanding California S Property Taxes

Diversity Retail Real Estate The Top 20 Multicultural Markets Commercial Property Executive Marketing Retail Retail News