2022 tax refund calculator canada

This tax calculator will be updated during 2022 as new 2022 IRS tax return data becomes available. We are a community of solvers combining human ingenuity experience and technology innovation to deliver sustained outcomes and build trust.

:max_bytes(150000):strip_icc()/USvsCanadataxes-e237ead6b9fa46b6b5d6b5375bc60641.jpg)

Canada Vs U S Tax Rates Do Canadians Pay More

The first of the Government of Canadas new financial support measures will take effect this Friday November 4 2022 with the additional one-time goods and services tax credit.

. FREE- Simple tax calculator to quickly estimate your Canadian Income Tax for 2022. The personal income tax rate in Canada is progressive and assessed both on the federal level and the provincial level. The amount of income tax that was deducted from your paycheque.

You can use advanced features to provide a bespoke tax return tax refund example and email this. The tax rates for Ontario in 2022 are as follows. Ontario income tax rates in 2022 range from 505 to 1316.

Amounts earned up to 46226 are taxed at 505. Check how much taxes you need to pay on CERB CRSB CESB CRB and much more. Calculate your combined federal and provincial tax bill in each province and territory.

Federal tax rates range from 15 to 33 depending on your income while. 29 on the next 63895 of taxable income on the portion of. 26 on the next 53404 of taxable income on the portion of taxable income over 97069 up to 150473 plus.

Your average tax rate is. You can also create your new 2022 W-4 at the end of the tool on the tax return result. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043. This means that you are taxed at 205 from. That means that your net pay will be 37957 per year or 3163 per month.

Canada Tax Calculator 202223. Amounts above 46226 up to 92454 are taxed at 915. For amounts 92454 up to.

Federal income tax rates in 2022 range from 15 to 33. 2022 Personal tax calculator. Use the Canada Tax.

Use our Income tax calculator to quickly estimate your federal and provincial taxes and your 2021 income tax refund. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. The Canada Tax Calculator by iCalculator is designed to allow detailed salary and income tax calculations for each province in Canada.

The calculator reflects known rates as of June 1 2022. For example in the 2021 tax season if you earn 80000 you will be in the 49020 to 98040 tax bracket with a tax rate of 205. The tax calculators are designed to be simple requiring no more than entering your earnings.

Your Canadian income tax refund depends on your total annual income your deductions and how much tax you have already paid or had withheld at source.

Simple Tax Guide For Americans In Canada

Free Tax Calculators Money Saving Tools 2021 2022 Turbotax Official

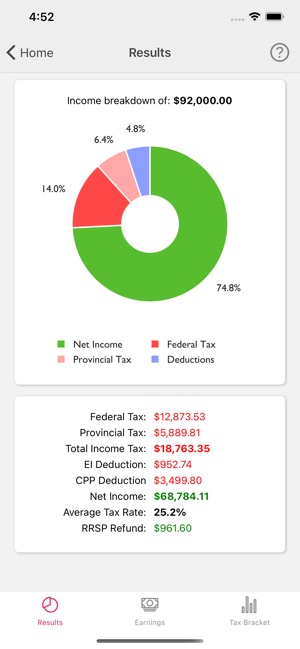

Canada Income Tax Calculator On The App Store

2022 Canada Income Tax Calculator Turbotax Canada

How To Estimate Your Tax Refund Lovetoknow

Small Business Tax Returns In Canada 2022 Revenues Profits

Marginal Tax Rates How To Calculate Ontario Income Tax Kalfa Law

2022 Canada Tax Documents Checklist What Do You Need

Tax Calculator Refund Return Estimator 2022 2023 Turbotax Official

Average Earned Personal Income Grows In July 2022 Seeking Alpha

Tax Year 2023 January December 2023 Plan Your Taxes

How To File Income Tax Return To Get Refund In Canada 2022

3 Reasons Why You Don T Want A Big Tax Refund Northwestern Mutual

2022 Taxes 8 Things To Know Now Charles Schwab

Federal Income Tax Return Calculator Nerdwallet

Ey 2022 Tax Calculators Rates Ey Canada

Business Tax Deadline In 2022 For Small Businesses